Unmasking the Biggest Financial Decisions in Your Life

Image Alt Text: biggest financial decisions in your life

Introduction

In the grand tapestry of life, several threads weave together to create our financial future. Each thread represents a financial decision, and when woven correctly, they form a solid financial foundation. But when these decisions become complicated or overwhelming - particularly during life's major transitions - we often need guidance. Enter 'NewMaker Financial' - your partner in navigating the complexities of life's biggest financial decisions. This article, titled '"Unmasking the Biggest Financial Decisions in Your Life"', will unveil the significance of these financial choices and how they shape your financial health. Whether you are dealing with the loss of a parent, a job loss, or going through a divorce, understanding these decisions can empower you to take control of your financial future.

The Importance of Making Sound Financial Decisions

Money, they say, makes the world go round. But what they don't often tell you is that it's not just about having money - it's about making the right decisions with that money that truly matters. These decisions have the power to either propel you towards financial stability or plunge you into financial turmoil.

Sound financial decisions underpin the structure of your financial health. They set the stage for how you manage your money now and in the future. For someone going through a major life transition, such as a divorce, loss of a parent, or job loss, these decisions can seem daunting. But with the right guidance and knowledge, you can navigate through these challenges and secure your financial future.

Why are Sound Financial Decisions Crucial?

They say that every dollar you spend is an investment in your future. But how you spend that dollar - or save it, invest it, or donate it - can have a tremendous impact on your life's trajectory. Making sound financial decisions means understanding the implications of each financial choice you make and optimizing those choices for your long-term benefit.

Whether it's deciding to live below your means, invest wisely, or plan for retirement, each decision plays a pivotal role in shaping your financial portrait. For instance, as Jack Brennan, the former CEO of Vanguard, points out, living within your means is "the single most important thing to do" to accumulate wealth.

On the other hand, poor financial decisions can lead to years of financial struggles. Overspending, ignoring to plan for the future, or failing to protect your assets can lead to financial distress.

The Impact of Major Life Transitions on Financial Decisions

Major life transitions, such as marriage, parenthood, home ownership, divorce, and the loss of a loved one, come with their own set of financial decisions. Each of these transitions alters your financial landscape, often requiring you to reassess your financial goals and strategies.

During these times, it's easy to feel lost and overwhelmed. But remember, every financial decision you make during these transitions can either move you closer to your financial goals or set you back.

For example, buying a home is a significant milestone, but it comes with substantial financial obligations like down payments, mortgage payments, property taxes, and maintenance costs. Making an informed decision about home ownership involves evaluating your financial readiness, considering your long-term goals, and calculating how much house you can afford.

The death of a loved one, on the other hand, is often accompanied by financial responsibilities like funeral costs, estate administration, and potential inheritance decisions. Navigating these can be challenging and emotionally taxing. However, making informed financial decisions during this time can help alleviate the stress and set you on a path towards financial stability.

In conclusion, making sound financial decisions is integral to your financial wellbeing. It's about understanding the implications of each choice and making decisions that align with your financial goals and circumstances. As we delve deeper into the biggest financial decisions in your life, keep in mind the importance of making choices that support your financial health and stability.

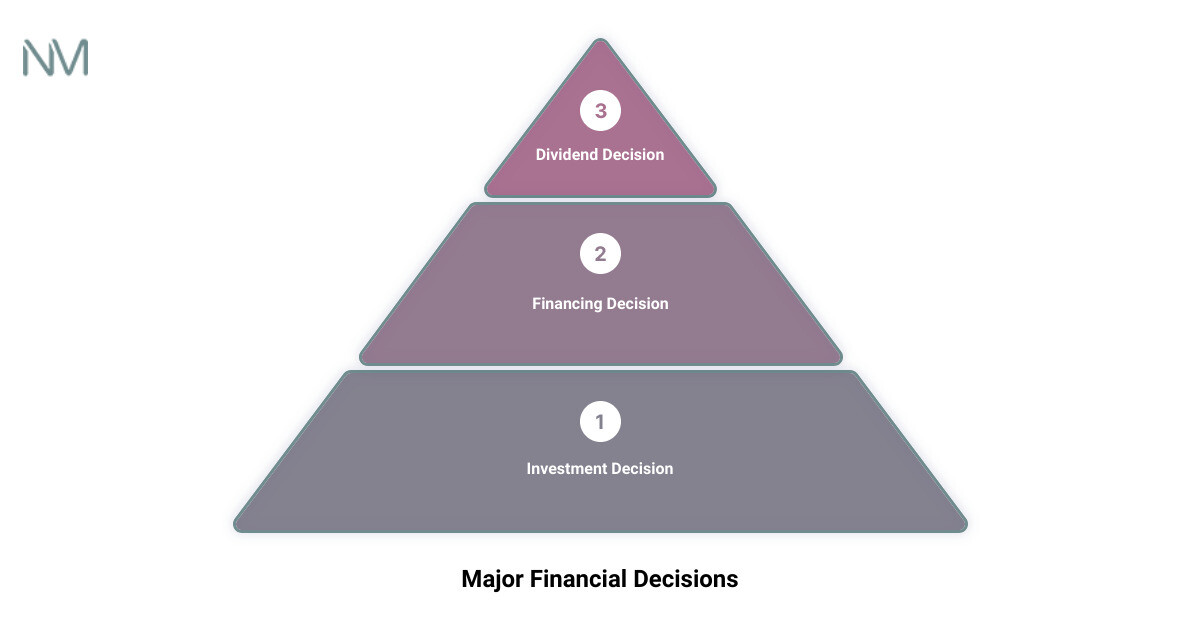

Image Alt Text: biggest financial decisions in your life3 stage pyramid

The Four Major Types of Financial Decisions

As you navigate through life's ups and downs, you'll encounter four major types of financial decisions. Each one plays a crucial role in maintaining your financial stability and ensuring that you're on the right path towards your financial goals.

Investment Decision

The first major type of financial decision is the investment decision. This involves determining where to allocate your funds to yield the highest possible returns. You might be considering investing in stocks, bonds, real estate, or even a startup business. Making wise investment decisions requires an understanding of the risks involved, the potential return on investment, and how each investment aligns with your overall financial goals.

Financing Decision

Next is the financing decision. This refers to how you choose to fund your activities or investments. You might decide to use your own savings, take out a loan, or even attract investors. The aim of a financing decision is to minimize the cost of capital while ensuring enough liquidity to cover all expenses. It's crucial to be aware of the implications of debt and equity in this decision-making process.

Dividend Decision

The third type of financial decision is the dividend decision. If you own shares in a company, you'll be faced with the decision of whether to take dividends as cash or reinvest them back into the company. This decision is typically based on your current financial needs, future financial goals, and the performance of the company.

Working Capital Decisions

Finally, working capital decisions involve managing your day-to-day finances. This includes decisions related to your cash flow, inventory management, debt collection, and short-term financing. Working capital decisions are vital for maintaining your financial stability and meeting your immediate financial obligations.

In conclusion, understanding these four types of financial decisions is crucial for navigating your financial journey, especially during major life transitions. By making informed decisions in each of these areas, you can better manage your finances, mitigate financial risks, and move closer to your financial goals.

The Biggest Financial Decisions in Your Life

Navigating through life's ups and downs can be a challenge, especially when it comes to making the biggest financial decisions. Here we'll uncover some of the most significant choices you're likely to face and offer some insights to help you make informed decisions.

Decision to Pursue Higher Education

One of the earliest financial decisions many people face is whether to pursue higher education. This decision is a significant financial investment that can shape your career and your financial future. Consider the costs of tuition, the duration of your studies, and the potential income and opportunities your chosen field may offer.

Decision to Buy a Home

Buying a home is another major financial decision. It involves evaluating your financial readiness, calculating how much house you can afford, and planning for costs like down payments, mortgage payments, property taxes, and maintenance.

Decision to Live Below Your Means and Avoid Debt

Choosing to live below your means can be a game-changer for your financial stability. This decision involves careful budgeting, avoiding unnecessary debt, and prioritizing savings. It's an essential strategy for building wealth in the long run.

Decision to Invest Wisely and Early

Investing wisely and starting early is a crucial financial decision. It can help you accumulate wealth over time, provide for your retirement, and achieve your financial goals. The earlier you start investing, the more time you'll have for your investments to grow.

Decision to Pursue a Traditional Career or Follow Your Passion

Choosing your career path is another significant decision that has long-term financial implications. Some people may opt for a traditional career path with stable income potential, while others may choose to follow their passion, even if it carries financial risks. It's important to balance your career aspirations with practical financial considerations.

Decision to Plan for Retirement

Planning for retirement is a critical financial decision that impacts your financial security in the later stages of life. It's important to start early, contribute regularly to your retirement fund, and consider diversifying your investment portfolio to mitigate risks.

Decision to Protect Your Assets

Protecting your assets is another crucial decision. This might involve purchasing insurance policies, creating an emergency fund, or setting up a will or trust. These measures can help safeguard your financial stability against unforeseen circumstances.

Decision to Plan for College Education

If you're a parent, planning for your child's college education can be another significant financial decision. This might involve setting up a college fund, exploring scholarship opportunities, or considering other financing options.

In conclusion, these are some of the biggest financial decisions you'll make in your life. Each has its own unique challenges and implications. Making informed decisions in each of these areas can help you navigate through life's transitions with financial confidence.

Image Alt Text: biggest financial decisions in your lifecause effect

How NewMaker Financial Can Help You Make These Decisions

Congrats on taking the first step towards making informed financial decisions! It's a brave move considering the complex nature of these decisions and their long-term impact on your life. But you're not alone on this journey. This is where NewMaker Financial steps in as your trusted financial partner, ready to guide you through the maze of financial decisions.

NewMaker Financial understands that your financial decisions are not just about numbers. They're about your life, your dreams, and your future. Our role is to help you make sense of these decisions in the context of your unique situation and goals. We're not here to give you a one-size-fits-all answer but to help you understand the choices you have and their potential implications.

Customized Solutions for Your Unique Situation

Life transitions like getting married, having a child, buying a home, dealing with job loss, going through a divorce, or coping with the loss of a loved one all require unique financial approaches. At NewMaker Financial, we provide personalized financial advice tailored to your specific situation, respecting your concerns and being transparent in our dealings. Our aim is to empower you to make the best financial decisions during these transitions.[^1^]

Building Financial Resilience

We believe in the power of financial resilience. This means having the financial stability to weather life's storms and the financial flexibility to seize opportunities when they arise. Our team of experts can help you build this resilience by guiding you on how to live below your means, avoid unnecessary debt, invest wisely and early, and plan for retirement. These are some of the most critical financial decisions that can contribute to your financial resilience and long-term security.[^2^]

Asset Protection and Estate Planning

Protecting your hard-earned assets and planning for the future isn't just about having insurance or writing a will. It's about understanding the risks you face, choosing the right protection strategies, and ensuring your wishes will be carried out if something happens to you. At NewMaker Financial, we can help you navigate this complex area, providing you with peace of mind that your financial future is secure.[^3^]

Education Planning

If you're planning for your child's college education, we can help you explore the best options, from setting up a college fund to exploring scholarship opportunities and other financing options. We understand that every family's situation is different, and we're here to help you make the best decision for your family.[^4^]

At NewMaker Financial, we are committed to helping you navigate these financial decisions with confidence and clarity. Reach out to us and let's start the journey to your new financial future together!

Conclusion

Deciphering the labyrinth of financial decisions throughout life's journey can be a strenuous task. Whether it's choosing to invest in higher education, buying a home, planning for retirement, or navigating life transitions like divorce or job loss, each decision you make has a significant impact on your financial future. These decisions can be daunting and overwhelming, especially when you're in the midst of a major life change. However, making informed and prudent financial decisions is not just a necessity, but a pathway to a secure and prosperous future.

Remember, it's not just about surviving these transitions—it's about thriving during and after them. It's about taking control of your financial life, regardless of the changes you're experiencing. It's about creating a life of your own choosing, a life that aligns with your dreams and aspirations.

At NewMaker Financial, we understand the intricacies of these financial decisions and the impact they can have on your life. We stand with you in these transitions, ready to offer our expertise and support. We aim to empower you with the necessary knowledge and tools to navigate these financial decisions and transitions with confidence and clarity.

In the end, the biggest financial decisions in your life are not just about numbers on a balance sheet. They're about your dreams, your goals, and your values. They're about your life. And with NewMaker Financial as your partner, you can make these decisions confidently, knowing that you're not alone.

So, are you ready to unmask the biggest financial decisions in your life? Reach out to us at NewMaker Financial. Let's start the journey to your new financial future together. Remember, it's not just about surviving these transitions—it's about thriving during and after them. It's about taking control of your financial life, regardless of the changes you're experiencing, and making financial decisions that align with your dreams and aspirations. With NewMaker Financial, your financial future is in good hands.

Image Alt Text: question mark

Frequently Asked Questions

Navigating the financial landscape can often feel like learning a new language, filled with complex terminologies and concepts. However, understanding the fundamentals can greatly aid in making informed decisions. Here are some frequently asked questions about financial decisions and their answers.

What are the 3 main decisions in finance?

In the financial management of a company, there are three primary decisions that are usually made. These include the Investment Decision, which involves determining where funds should be invested to ensure maximum returns. The Financing Decision, which revolves around deciding the best way to raise the necessary funds, balancing between equity and debt. Lastly, the Dividend Decision, which is about determining the proportion of earnings to be paid out as dividends to shareholders and what portion to retain in the company for growth.

What is an example of a financial decision?

Financial decisions vary in nature and can be as simple as deciding how to budget monthly income or as complex as deciding on the capital structure of a company. For instance, a company's capital structure decision involves determining the proportion of debt and equity used to finance its operations. The goal is to minimize the cost of capital while maintaining enough liquidity to meet all expenses.

What are the five financial decisions?

When dealing with financial decisions, there are five key considerations. These involve asking questions about costs and risks, verifying and validating information, estimating your expenses, assessing the value of your decision, and finally deciding whether the costs and potential value are worth it. In essence, these steps work as a guide for making sound financial decisions.

What are the 4 financial decisions?

Financial decision-making can be divided into four primary types: Financing Decision (deciding the best way to obtain funds), Investment Decision (choosing the best investment opportunities), Dividend Decision (deciding on the division of earnings between dividends and retained earnings), and Working Capital Decisions (managing short-term assets and liabilities). These decisions are all interconnected and play crucial roles in determining a company's financial health and growth potential.

By understanding these financial decisions, you can better navigate your financial journey. Remember, making informed decisions can significantly impact the path to achieving your financial goals. And in all of this, NewMaker Financial is here to guide you.