Choosing the Right Financial Advisor for Inheritance: Secure Your Wealth

For many of us, wealth passed down can instantaneously change our financial landscape. Receiving an inheritance is a financial event that can significantly impact your life, offering immense opportunities yet presenting complex challenges. It goes beyond the initial emotional response and quickly transforms into a labyrinth of tax implications, a collision with current financial plans, and the mounting pressure to make the right financial decisions. This can be especially daunting if you're currently going through a major life transition like a divorce, job loss, or the loss of a loved one.

At NewMaker Financial, we understand the emotional and financial implications that come with an inheritance. We recognize the diverse forms of inherited assets and navigate the different tax implications for each, relieving you of the added stress during this time. Our goal is to offer guidance and support during this transition, provide valuable counsel, and help secure your inheritance in the best possible way.

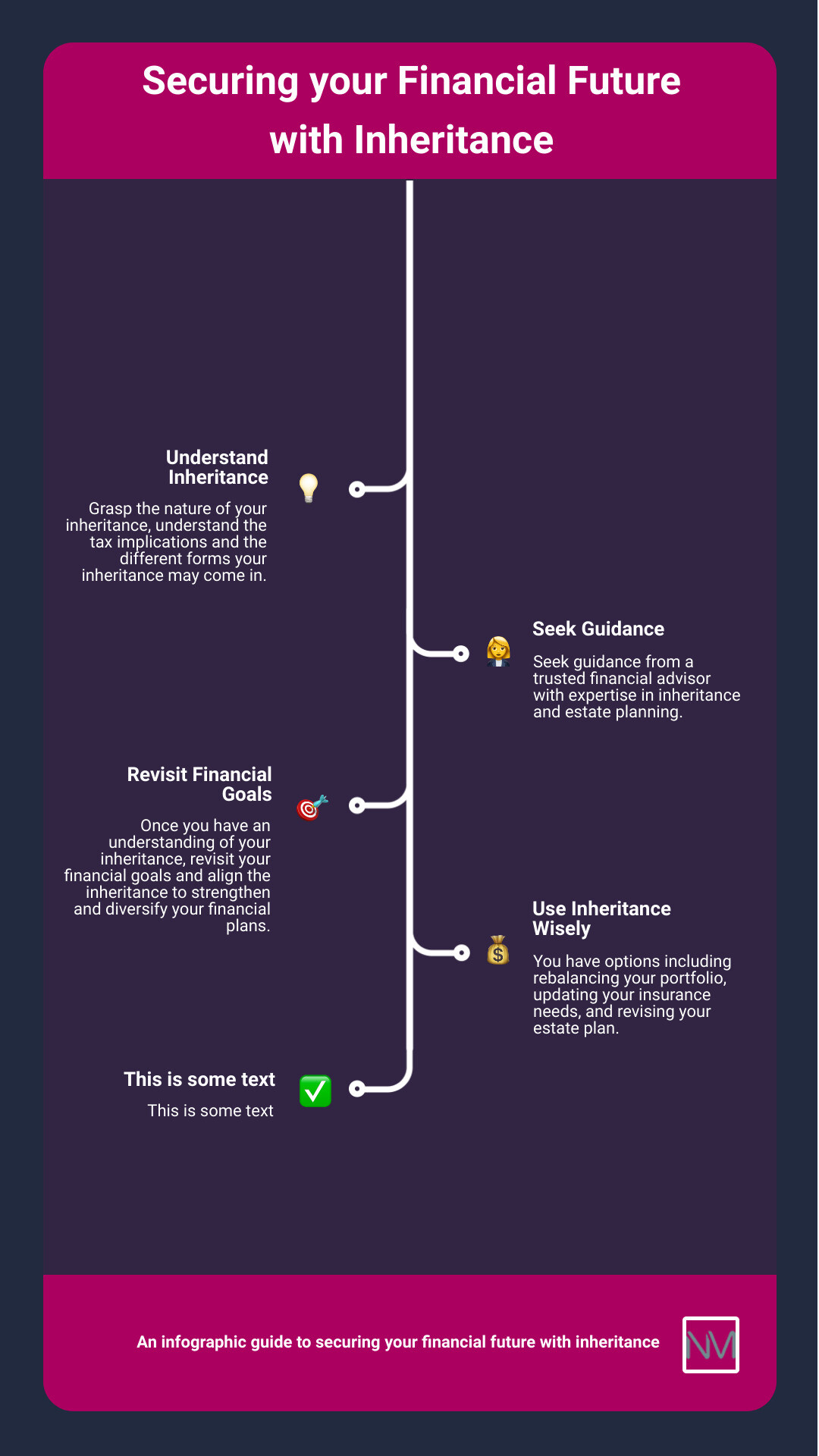

At a glance, here are the key steps you need to consider when navigating an inheritance:

- Grasp the nature of your inheritance: Understand the tax implications and the different forms your inheritance may come in.

- Seek guidance from a trusted financial advisor with expertise in inheritance and estate planning: They will guide you through the process in a legally compliant and tax-efficient manner.

- Once you have an understanding of your inheritance, revisit your financial goals: Align the inheritance to strengthen and diversify your financial plans.

- Use your inheritance wisely: You have options including rebalancing your portfolio, updating your insurance needs, and revising your estate plan.

Understanding and maneuvering around these steps can be overwhelming, and that's where we can help. As you read on, we will break down each step, discuss why they matter, and help you transform this unnerving event into a secure financial future. So stick with us as we explore the importance of choosing the right financial advisor for managing your inheritance, and rest assured that your wealth is in capable hands.

Understanding the Nature of Your Inheritance

The first step in securely managing your inheritance is understanding what you're inheriting. Knowledge is power, and in this case, it's the power to make informed decisions that align with your financial goals and circumstances.

Different Forms of Inheritance: Retirement Accounts, Family Homes, and More

Inheritances come in various forms, which can range from retirement plans and cash endowments to real estate properties and businesses. Each form of inheritance carries its own set of complexities that you need to navigate.

For instance, you might find yourself dealing with retirement accounts like IRAs, 401(k)s, or stocks and bonds. On the other hand, your inheritance might also be in the form of real assets like the family home or a business. As you can see, the scope of inheritance can be wide-ranging, and each comes with its own set of financial implications to consider.

Tax Implications of Inherited Assets: IRAs, 401(k)s, and Taxable Accounts

While receiving an inheritance can feel like a financial boon, it's crucial to understand the tax implications that come with it. For instance, if you've inherited a variety of asset types like IRAs or other investment assets, several different tax treatments may apply.

Inherited IRAs can be particularly tricky. The rules surrounding them are complex and vary depending on several factors, including your relationship with the deceased. The tax penalty for not following the rules can be severe, up to 50% of the amount not taken.

Inherited stocks and other investment assets have their own tax implications. They're generally based on the fair market value of the asset on the date of the decedent’s death, not at the original cost. This is known as the step-up in basis, which can affect the amount of capital gains tax you pay when you sell the assets.

Real Assets Conversion: Dealing with Homes or Businesses

When it comes to real assets like a family home or business, things can get even more complicated, especially if multiple beneficiaries are involved. Converting these assets into cash can be a complex process, and if there are disputes over a will, it could take years for the issues to be resolved.

At NewMaker Financial, we've seen how these complexities can overwhelm heirs. That's why we believe in the importance of understanding the nature of your inheritance. By doing so, you can prepare yourself for the decisions and challenges that lie ahead, helping to reduce stress and avoid potential pitfalls.

So whether you're dealing with retirement accounts, real assets, or a mix of both, understanding the nature of your inheritance is the first crucial step toward securing your wealth. In the next section, we'll delve into the role of a financial advisor in managing your inheritance and how they can help you navigate these intricacies.

The Role of a Financial Advisor in Managing Inheritance

When it comes to managing an inheritance, the landscape can be overwhelming and fraught with emotional and financial complexities. This is where a skilled financial advisor can help you navigate these challenges. Whether it's understanding tax implications or deciding on the best way to use your newly acquired wealth, a financial advisor can provide the guidance and expertise you need.

How Financial Advisors Can Help You Make the Most of Your Inheritance

A financial advisor can offer a clear, objective perspective, cutting through the noise of unsolicited advice from friends and family. They can help you create a comprehensive financial plan that addresses your unique needs and long-term goals. This plan could include strategies for investing part of the inheritance for future needs, such as your children's college expenses, or funding a family trust.

At NewMaker Financial, we ensure that your inheritance doesn't go to waste. We help clients understand the assets they now own, from real estate and investments to life insurance policies and family businesses, guiding them to make smart decisions about how to spend, save, or invest the inheritance.

The Cost and Minimum Asset Threshold for Hiring a Financial Advisor

The cost of hiring a financial advisor can vary based on multiple factors such as the complexity of your financial situation, the advisor's level of experience, and the services required. At NewMaker Financial, we offer options for how you are billed for our services, including investment solutions based on assets under management or on a commissionable basis. We always discuss these options with you upfront, ensuring transparency and understanding.

As for the minimum asset threshold, it's important to note that financial advising is not only for the ultra-wealthy. Many advisors, including us at NewMaker Financial, work with a variety of clients with diverse financial backgrounds.

The Benefits of Hiring a Financial Advisor: Peace of Mind and Wealth Growth

Hiring a financial advisor can offer peace of mind during an emotionally difficult time. Their expert advice on investments, retirement accounts, taxes, and more can help you avoid costly mistakes, ensuring that your inheritance is managed effectively.

Furthermore, a financial advisor can help you strike a balance between improving your short-term financial situation and meeting your long-term goals. They can help you grow your wealth in a strategic and sustainable manner, allowing you to lead a lifestyle that aligns with your definition of wealth.

At NewMaker Financial, we don’t just help manage your wealth; we strive to be your valued partner. We illuminate the future for you, helping you see beyond the immediate emotional landscape and make informed decisions. Our mission is to ensure you can navigate your inheritance with confidence and security, no matter the size or complexity.

In the next section, we'll explore key considerations when choosing a financial advisor for inheritance management. This includes understanding their fiduciary duty, their expertise in inheritance and estate planning, and the importance of a trustworthy advisor.

Key Considerations When Choosing a Financial Advisor for Inheritance

Choosing the right financial advisor is like finding a trustworthy compass to guide you through the dense forest of financial decisions. But what makes a great advisor stand out? Let's delve into a few critical factors to consider.

Fiduciary Duty: Ensuring Your Advisor Has Your Best Interests at Heart

A financial advisor with a fiduciary duty is a guardian angel in the financial world. They are legally obligated to act in your best interest, offering unbiased advice instead of pushing certain investments for commission.

At NewMaker Financial, we act as fiduciaries in our advisory relationships, always putting your financial needs and goals first. You can rest assured that we offer investment solutions that best suit your circumstances and aspirations.

Expertise in Inheritance and Estate Planning: Why It Matters

Inheritance management is a unique field that requires specialized expertise. An advisor experienced in inheritance can help you navigate complex tax implications, understand the nature of your inherited assets, and make the most of your newfound wealth.

Our team at NewMaker Financial brings years of expertise in estate planning and inheritance management. Whether you need help updating your beneficiaries or preparing for a meeting with an attorney, we're here to guide you every step of the way.

Approachability and Reliability: The Importance of a Trustworthy Advisor

Inheritance is not just a financial matter; it's also an emotionally charged event. A reliable and approachable advisor can help ease your stress, answer your questions, and provide the emotional support you need during this time.

We pride ourselves on our client-focused approach, ensuring you feel comfortable and supported throughout your journey with us. We understand that each client's situation is unique, and we're committed to providing personalized advice and solutions that fit your specific needs.

Inheritance can be a complex and overwhelming process, but with the right financial advisor by your side, you can navigate this journey with ease and confidence. Remember, it's crucial to choose an advisor who is not only experienced and knowledgeable but also one with whom you feel comfortable discussing your financial situation and goals. Your financial future is too important to leave to chance, so choose wisely.

Navigating the Emotional and Financial Challenges of Inheritance

Inheriting wealth is a complex process that requires careful planning and management. It's not just about the financial aspects; it's also about handling the emotional challenges that come with it. At NewMaker Financial, we understand these complexities and are here to guide you through them.

Dealing with Disputes Over a Will and Prolonged Resolution Process

After the death of a loved one, you might face disputes over the will or a prolonged resolution process. This can be emotionally draining and may further complicate your financial situation. It's crucial to remember that handling the legal aspects of an inheritance can be tedious and often requires professional assistance. At NewMaker Financial, we can help you navigate through these legal challenges and ensure that your inherited assets are managed properly.

Handling Emotional Challenges When Inheriting More Money Than Other Family Members

Inheriting more money than other family members can lead to feelings of guilt or unease. It's essential to approach this situation with empathy and understanding. Communication is key in these circumstances, as is seeking professional advice. We at NewMaker Financial can provide you with the guidance and support you need during this sensitive time.

The Risks of Loaning Newly Inherited Money to Friends or Family

On receiving an inheritance, you may face pressure to loan money to friends or family. As one Reddit user wisely advises, you should almost certainly never loan newly inherited money out to friends or family. This is because your inheritance is likely to be the most significant windfall you’ll ever receive, so you have to make it work for you. Here at NewMaker Financial, we can help you make the best possible decisions for your financial future.

In conclusion, navigating the emotional and financial challenges of an inheritance can be overwhelming. But with the right guidance and support, you can manage these challenges and secure your financial future. At NewMaker Financial, we are here to provide you with the expertise and advice you need during this significant life transition.

Creating a Comprehensive Financial Plan for Your Inheritance

When you inherit wealth, it's not just about what you've gained but also how you manage it. At NewMaker Financial, we believe in creating a comprehensive financial plan for your inheritance that aligns with your financial goals and maximizes your wealth preservation. Let's dive into the key components of this plan.

Assessing Your Debt and Determining the Best Course of Action

Dealing with debt can be a daunting task. However, an inheritance can provide a unique opportunity to manage and potentially eliminate your debt. It's important to assess your debt situation and determine the best course of action. High-interest debt, such as credit card debt, should be addressed as quickly as possible. However, low-interest debt, like mortgages, requires a more detailed evaluation. A financial advisor can guide you through this process, helping you make decisions that align with your financial health and long-term goals.

Revisiting Your Financial Goals and Aligning Them with Your Inheritance

An inheritance can significantly change your financial landscape. It's a good time to revisit your financial goals and explore how your newfound wealth can help achieve them. This could mean rebalancing your investment portfolio, enhancing your retirement savings, or creating an emergency fund. At NewMaker Financial, we will help you explore these options and tailor an investment strategy specific to your circumstances and goals.

Evaluating Your Insurance Needs and Updating Your Estate Plan

Inherited wealth may require you to re-evaluate your insurance needs. For instance, you might need to increase your property and casualty insurance coverage. Also, it's a good time to review your life insurance needs.

Receiving an inheritance also means considering your own legacy. You might want to update your estate plan or set up a new one, ensuring your assets are distributed according to your wishes. At NewMaker Financial, we can guide you through this process, working closely with your attorney to help minimize potential federal or state estate taxes for your beneficiaries.

Inheriting wealth brings along not just financial gains, but also the responsibility of managing it wisely. At NewMaker Financial, we believe in helping you navigate this path with confidence. Our team of experts will guide you through each step of the process, ensuring your inherited wealth is managed effectively to secure your financial future.

Conclusion: Secure Your Wealth with the Right Financial Advisor for Inheritance

It is a truth universally acknowledged that managing an inheritance can be a complex and emotional journey. It's not merely about dealing with the financial implications, but also navigating the emotional landscape that accompanies such a significant life event. Whether you have inherited a substantial sum or a collection of assets, having the right financial advisor by your side can make a world of difference.

At NewMaker Financial, we understand that each person's financial situation and goals are unique. That's why we take the time to understand your individual needs and create a bespoke financial plan tailored to your circumstances. We don't just provide investment advice; we offer holistic financial planning services that aim to enable you to secure and grow your wealth wisely.

Our team is dedicated to helping you make sound financial decisions that align with your goals, whether that's paying off debt, diversifying your investment portfolio, or creating an emergency fund. We understand the importance of navigating the tax implications of an inheritance correctly, and we strive to help you preserve your assets while adhering to tax laws.

Moreover, we are with you every step of the way, providing guidance and support as you navigate the challenges of managing an inheritance. We are more than just your financial advisors; we aim to be a reliable partner that empowers you to become a confident and knowledgeable investor.

In conclusion, managing an inheritance can be a daunting task, but with the right financial advisor, you can navigate the process with more assurance. Let us at NewMaker Financial help you turn this significant life event into a foundation for your financial future. Remember, wealth is not just about having more, but having enough to live the life you want.

With the right guidance and a solid financial plan, you can secure your wealth and ensure your inheritance supports your ideal lifestyle. Don't let the complexity of managing an inheritance overwhelm you. Reach out to us at NewMaker Financial today, and let us help you navigate this journey with confidence and clarity.

Thank you for choosing NewMaker Financial. We look forward to partnering with you in securing your financial future.

This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2023 Advisor Websites.