Navigating Financial Planning After Divorce: Tips and Strategies

Navigating a divorce can feel like steering a ship in stormy weather—uncertain, challenging, and daunting. On top of the emotional turmoil, numerous financial concerns arise. From understanding and dividing assets to rebuilding financial independence, the process can be overwhelming—a labyrinth of complexities where every decision impacts the future. It's during this transformative period that prudent financial planning after divorce becomes paramount.

At NewMaker Financial, we understand that amidst the hardship and confusion, you need guidance to make informed and beneficial decisions. These choices will lay the groundwork for your future financial well-being—one that is strong, secure, and independent. This article is not only a beacon in the storm, offering knowledge and understanding, but also a compass, pointing you towards the most financially rewarding path through and after divorce.

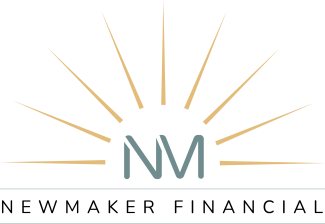

The Importance of Financial Planning After Divorce: A Snapshot

- It helps you understand your financial situation both in the immediate and long term.

- Assists in making informed decisions about asset division, debt management, and budgeting.

- Provides a road-map for aligning your financial goals with your new single-income status.

- Helps you avoid costly mistakes and ensures financial safety.

- It can take off your plate some of the chaos of the post-divorce life, letting you focus on emotional healing.

- A financial planner can partner with you on the emotional side, dealing with financial shame, emotional spending, and money anxiety.

In the ensuing sections, we will traverse this landscape together, outlining key strategies and insights to navigate the financial aspects of divorce. Together, we will illuminate the path towards a secure and independent financial future. This journey starts here, with understanding just how crucial financial planning after divorce is. So, take a deep breath and read on, as you begin the first step of securing your financial well-being post-divorce.

Assembling Your Professional Team

The journey towards financial security post-divorce begins with assembling the right team of professionals. This team will guide you through the complex maze of financial, legal, and tax implications that accompany divorce, ensuring you make informed decisions that protect your financial future.

The Role of a Financial Advisor in Divorce

The first key player in your team should be a skilled financial advisor, specifically one who specializes in divorce financial planning. A divorce financial advisor brings an in-depth understanding of the unique financial intricacies that come with divorce.

They can help you evaluate the long-term impacts of various settlement proposals, ensuring the decisions you make today will not harm your financial situation in the future. Moreover, they can assist in developing a strategic plan that safeguards your financial future, minimizing potential post-divorce financial mistakes that could take years to recover from.

At NewMaker Financial, our experienced financial advisors are here to ensure you fully comprehend your options, the true value of your assets, and how your decisions during the divorce can impact your future financial health.

The Importance of a Divorce Attorney

While a financial advisor handles the financial complexities of your divorce, a seasoned family law attorney navigates the legal intricacies. They help you understand your rights and obligations, guide you through the legal process, and advocate for your best interests in court or during negotiations.

The Role of a Tax Advisor in Divorce

Divorce can also bring about significant tax implications. A tax advisor who understands divorce-related tax issues can guide you through potential tax liabilities and benefits, helping to prevent a surprise tax bill from showing up at your doorstep. They can also advise on how to structure your divorce settlement to optimize tax outcomes.

Why You Need an Estate Planning Attorney

Lastly, an estate planning attorney is crucial in the post-divorce process. Divorce changes the dynamics of your estate plan, including beneficiary designations, wills, trusts, power of attorney, and healthcare proxy appointments. An estate planning attorney can help you update these in line with your new financial and personal circumstances, ensuring your assets are protected and will be distributed according to your wishes after your death.

At NewMaker Financial, we understand the emotional turmoil that accompanies divorce. We're here to support you through the financial complexities, ensuring you make informed decisions that protect your financial future. By assembling a team of seasoned professionals, you can navigate the divorce process with confidence, knowing you're on the path towards financial independence post-divorce.

Understanding and Dividing Assets

One of the most critical steps in the process of divorce is understanding and dividing your assets. This process can be complex and emotionally charged, but with the right guidance and expertise, it can also pave the way toward a more secure financial future.

Creating a Comprehensive List of Assets

The first step in the asset division process is creating a comprehensive list of all your assets. This includes everything from bank accounts and property, to retirement accounts and investments. As Jared Spinelli, a divorce attorney at Rubin and Rudman LLP, explains, it's not uncommon to discover hidden assets during this process. Therefore, it's crucial to be thorough and enlist the help of a professional to ensure nothing is overlooked.

At NewMaker Financial, we assist our clients in this process, ensuring all assets are accounted for and valuated accurately. We understand that it's not just about the numbers, but also about providing clarity and transparency during a challenging time.

Understanding Tax Implications of Asset Division

Once you have a list of assets, the next step is to understand the tax implications of dividing these assets. Different assets are taxed in different ways. For example, money in retirement accounts is fully taxable as regular income, while investments in a brokerage account are subject to long-term capital gains tax rates when sold.

Understanding these differences is essential when negotiating an asset division agreement. Without this knowledge, you may end up with a settlement that seems fair on the surface, but has negative tax implications down the line. Our team at NewMaker Financial provides expert guidance to help you navigate these complexities and avoid potential tax pitfalls.

Considering Liquidity and Cash Flow in Asset Division

In addition to tax implications, it's also important to consider the liquidity and cash flow of the assets being divided. For example, real estate isn't liquid until sold, and withdrawals from retirement accounts before age 59 1/2 can incur penalties. These considerations can impact your ability to cover expenses after the divorce.

At NewMaker Financial, we work closely with our clients to understand their liquidity needs and develop strategies to ensure they have access to the funds they need post-divorce.

Special Considerations for Retirement Accounts, Mortgages, and Stock Options

Certain assets require special considerations during a divorce. For example, splitting a 401(k) or a pension plan requires a qualified domestic relations order (QDRO), which can add time and expense to the process. Mortgages and stock options also have unique challenges that need to be addressed during the asset division process.

We have the expertise to guide you through these complexities, ensuring you understand the implications and make informed decisions.

Determining Marital Assets and Understanding State Laws

Finally, it's crucial to understand which assets are considered marital assets and how they're divided according to your state laws. Not all states divide assets on a 50-50 basis, and the determination of which assets are considered marital can vary.

At NewMaker Financial, we help you navigate these laws and ensure a fair division of assets, setting you on the path to financial independence after divorce.

In the next section, we will explore the steps you need to take for financial planning after divorce, including updating your estate plan, creating a post-divorce budget, and rebuilding your finances. Together, we can navigate through these financial complexities and set you on the path towards a secure financial future.

Post-Divorce Financial Planning

Divorce can be a challenging journey, but when it comes to your finances, it doesn't have to be. Armed with knowledge and expert guidance, you can navigate through the financial complexities of post-divorce life and set yourself on the path to stability and independence. From updating beneficiary designations and life insurance policies to revising your estate plan and creating a new budget, it's time to rebuild your financial life.

Updating Beneficiary Designations and Life Insurance Policies

Often overlooked in the whirlwind of divorce proceedings, updating your beneficiary designations is a crucial first step. You may not want your ex-spouse to be the beneficiary of your retirement accounts or life insurance policies. By changing your beneficiary designations, you ensure your assets go to the persons you intend.

Similarly, it's crucial to review your life insurance policies. Your divorce agreement may require you or your ex-spouse to maintain a certain amount of life insurance coverage for a specific period, especially if you have minor children. This task requires careful tracking, and we at NewMaker Financial can help ensure that your insurance policies align with your new financial goals.

Revising Your Estate Plan

Another crucial step in post-divorce financial planning is revising your estate plan. After a divorce, your previous estate planning documents, such as wills, trusts, power of attorney, and healthcare proxy, may no longer reflect your wishes or circumstances.

We can guide you through the process of updating your estate plan, ensuring that your wealth is transferred to your chosen heirs or charities. We can also assist you in preparing for your meeting with an attorney, potentially saving you billable hours. If needed, we can help you find the right attorney to revise your estate plan.

Creating a Post-Divorce Budget

As you embark on your new life, it's essential to develop a realistic post-divorce budget. This budget should reflect your new income and expenses, helping you understand what your post-divorce lifestyle will look like.

Using our expertise, we can help you create a budget that provides a solid foundation for your future financial stability. This includes an in-depth cash flow analysis, allowing you to fully grasp your financial situation and make informed decisions.

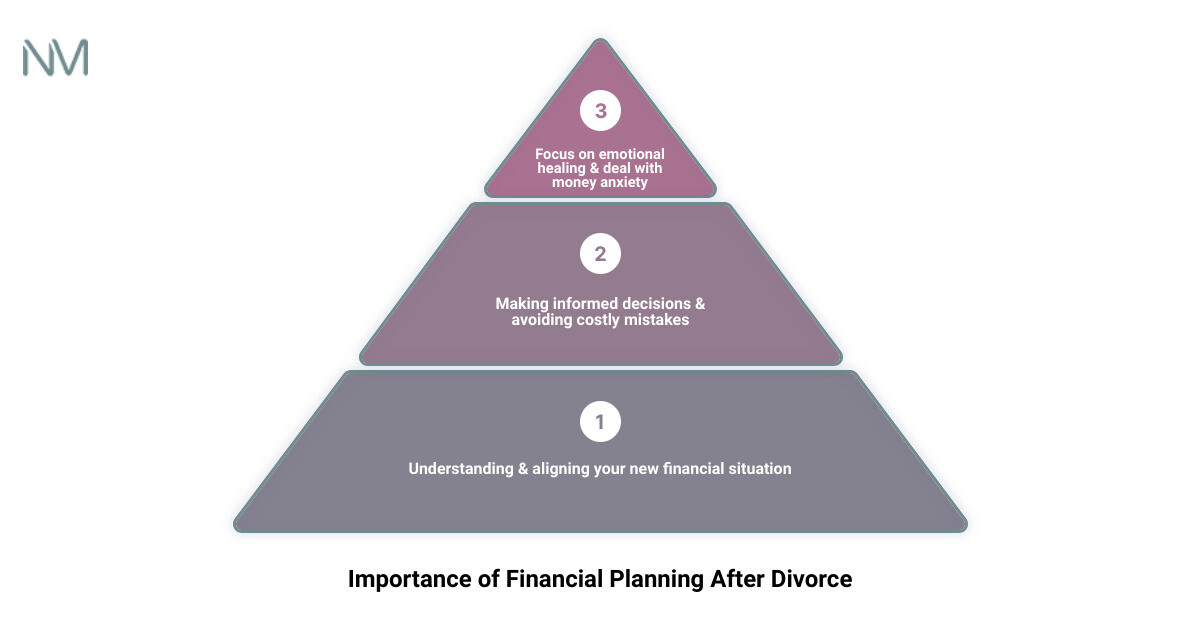

Rebuilding Your Finances: Steps to Take

The journey to financial independence post-divorce can be daunting, but it's achievable with the right planning and guidance. We recommend taking inventory of your current finances, opening your own accounts, and ensuring that you are paying or receiving appropriate support.

At NewMaker Financial, we understand that the emotional side of divorce can impact financial decisions. Our team is trained to help you overcome these challenges, providing you with the confidence to make sound financial choices and avoid costly mistakes.

Remember, rebuilding your finances doesn't happen overnight. It's a process that requires patience and perseverance. But with the right plan in place, you can navigate this new financial landscape with confidence and ease.

As you navigate through your post-divorce financial journey, remember that you're not alone. We at NewMaker Financial are here to provide you with the guidance and support you need to secure a stable financial future. Let's partner together to create a financial plan that aligns with your personal objectives and helps you rebuild your financial life after divorce.

Navigating Financial Support and Tax Implications

After the dust of divorce begins to settle, it's time to navigate the sometimes tricky world of financial support and tax implications. This phase involves understanding the nuances of spousal maintenance and child support, adjusting your tax filing status, and looking into possible spousal Social Security benefits. Let's break it down for you.

Understanding Spousal Maintenance and Child Support

One of the first aspects to consider is the issue of spousal maintenance and child support. If one spouse earns significantly less than the other, or is non-earning, spousal maintenance payments may be arranged. This financial support ensures that both parties maintain a standard of living comparable to that enjoyed during the marriage.

If there are minor children involved, the non-custodial spouse may be required to contribute child support payments regularly. This financial provision helps cover the children's living expenses, and may also include contributions towards health insurance premiums and deductibles for doctor visits. It's essential to bear in mind that these payments are not subject to income tax for the recipient and aren't deductible by the person making the payment.

Tax Implications of Divorce: Filing Status, Deductions, and More

Tax obligations can change significantly after a divorce. In the year the divorce is finalized, you can no longer file taxes jointly as a married couple. You'll need to choose whether to file as a single person or, if you qualify, as a "head of household." Each filing status has its own tax benefits, and your choice should be based on your specific situation.

Another aspect to consider is the handling of mortgage and property tax deductions in the year of divorce. Will these deductions be split, or will one spouse claim the deduction and compensate the other? As we make decisions about equitably dividing assets, we always consider their after-tax value.

Claiming Spousal Social Security Benefits After Divorce

Did you know that you may be eligible to claim spousal Social Security benefits based on your ex-spouse's earnings? If you were married for at least ten years, you can claim these benefits once you reach retirement age. This claim is valid as long as the benefit you're entitled to is larger than what you would receive on your own work record. However, you must have been divorced for at least two years and remain unmarried to qualify.

The spousal benefit equals one-half of the ex-spouse's benefit if both parties have reached full retirement age, which ranges from 65 to 67, depending on the date of birth. If you start receiving benefits before reaching full retirement age, your benefits will be reduced.

Navigating financial support and tax implications after a divorce can be complex. However, our team at NewMaker Financial is here to help you understand these changes and make informed decisions. Together, we can create a comprehensive financial plan that aligns with your new circumstances and helps you move forward with confidence.

Making Informed Decisions: Home Ownership and Expense Management

As you step into your new life after divorce, managing your finances wisely becomes even more crucial. This includes making decisions about your home, tracking expenses for realistic financial goal setting, and effectively managing your bills and taxes. At NewMaker Financial, we understand the emotional and financial complexities of divorce. We're here to guide you through these critical decisions, ensuring you maintain financial stability and security in this new chapter of your life.

Deciding Whether to Keep or Sell the Marital Home

One of the most significant financial decisions you'll face after a divorce is whether to keep or sell your marital home. This decision should not be made lightly, as it carries both financial and emotional implications.

Consider your financial readiness, long-term goals, and the costs associated with homeownership. If you decide to keep your home, ensure you can afford it on your income alone. This includes mortgage payments, property taxes, insurance, and maintenance costs.

If selling the house seems more practical, consult with a real estate expert to understand the current market conditions and the potential sale value of your home. Remember, selling your home can also have tax implications, so it's wise to discuss this decision with your tax advisor or financial planner at NewMaker Financial.

Tracking and Reporting Expenses for Realistic Financial Goals

After a divorce, your income and expenses will likely change. To adjust to this new financial reality, it's essential to create a budget that reflects your new income and expenses accurately.

Start by listing your income sources, such as work, alimony, child support, and investments. Next, track all your new expenses, including rent or mortgage payments, utilities, groceries, and any child-related costs. You may consider using an online budgeting and tracking system to help you manage your finances in real-time.

Remember, the goal is not to restrict your spending but to understand where your money is going and plan for financial stability. And here at NewMaker Financial, we can help you design a personalized financial plan that suits your new way of life.

Managing Bills and Taxes After Divorce

After your divorce, you'll need to update the Social Security Administration if you change your name. Also, consider checking your safe deposit box and setting up a new one if necessary. Regularly reviewing your financial documents and accounts can help you stay on top of your financial situation and avoid any unwelcome surprises.

Managing your tax situation post-divorce can also be complex. You'll need to consider income tax withholding, any required quarterly tax payments, capital gains or losses, and taxes on any retirement plan withdrawals.

At NewMaker Financial, we can guide you through these tax-related changes and help you understand your new tax liabilities. We're here to ensure that you're not only surviving your divorce but thriving financially in your new future.

Remember, taking control of your finances after a divorce can be empowering. It’s a long list of tasks to tackle, but just take it one step at a time. With the right support and guidance, you can navigate these financial complexities and build a stable, secure future for yourself.

Conclusion: The Path to Financial Independence After Divorce

Taking the first steps on the path to financial independence after divorce can be daunting. As you navigate the complexities of asset division, budgeting, and estate planning, it's crucial to remember that you're not alone. At NewMaker Financial, we're here to guide you every step of the way, providing the expert advice and compassionate support you need during this challenging time.

The process of financial planning after divorce involves more than just crunching numbers. It also encompasses understanding the emotional side of financial decisions and how they impact your long-term goals. Our team of experienced financial planners can help you overcome common financial challenges and fears that may arise post-divorce, such as emotional spending and money anxiety.

Remember, it's crucial to reassess your financial situation post-divorce. Creating a post-divorce budget, reviewing your savings strategy, and updating your beneficiary designations are all vital elements. Keep in mind that financial planning is not just about managing your money. It's also about setting goals and making informed decisions that align with your personal objectives and lifestyle.

If you're concerned about managing bills and taxes after your divorce, we can provide professional guidance. Our team can help you understand the tax implications of divorce and guide you through the process of claiming spousal Social Security benefits if applicable.

One of the most significant decisions you may face is whether to keep or sell the marital home. We can help you make an informed decision by considering factors like your financial stability, cash flow, and personal emotional attachment to the property.

Finally, remember the importance of assembling your professional team to guide you through the process. This team, which should include a financial advisor, divorce attorney, tax advisor, and estate planning attorney, can provide invaluable insight and support during this transition. At NewMaker Financial, we're committed to partnering with you on this journey, providing expert advice, and helping you move forward with confidence.

Navigating financial planning after divorce may feel overwhelming, but it's important to remember that you're taking the first steps towards a new chapter in your life. With patience, perseverance, and the right professional guidance, you can establish a firm financial foundation and achieve financial independence.

At NewMaker Financial, we're here to help you navigate these complexities and empower you to take control of your financial future. We believe that with the right support and advice, you can turn a challenging situation into a new opportunity for growth and independence.

We understand that every individual's situation is unique, and our team is committed to providing personalized, comprehensive financial planning solutions that meet your specific needs. So, take a deep breath, and let's embark on this journey to financial independence together.