The Definitive Guide to Divorce Fiduciary Financial Planning

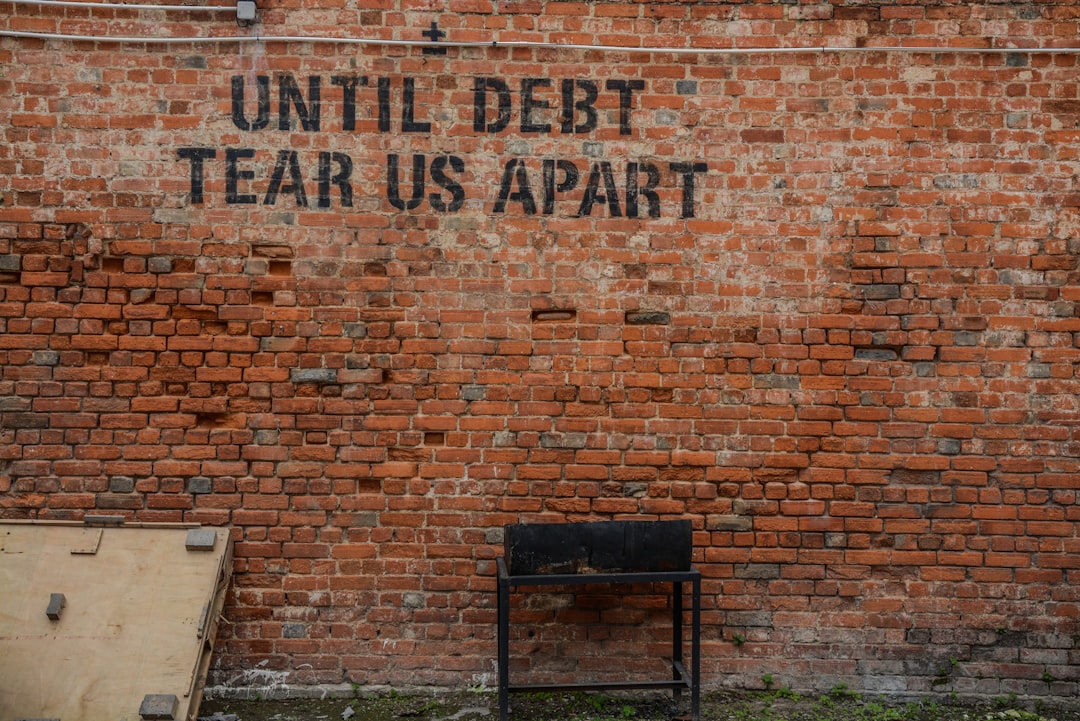

Are you feeling overwhelmed and unsure about your financial future in the face of a major life transition such as divorce? If so, let's pause for a second and breathe. The first thing to know is that you are not alone. Navigating the financial aspects of divorce can be daunting and it's completely normal to feel anxious and uncertain. Handling one's finances under the best circumstances can be challenging, and when one has to do so while going through a divorce, the task can become significantly more difficult.

Fortunately, this is where a divorce fiduciary financial planner can step in to shed light on the complexity of the situation. A fiduciary advisor can help you clearly understand your assets, your debts, and most importantly, devise a financial plan to safeguard your future. The right guidance can ease your stress during this critical juncture, helping you maintain your financial integrity and equipping you to set forth on your new journey with confidence.

To give you a sense of the key role a divorce fiduciary financial planner plays, here's a quick overview:

- Asset evaluation and division: Determine the value of your marital assets and the best way to divide them.

- Financial strategy: Develop a plan to manage your finances post-divorce, ensuring you remain financially confident.

- Debt management: Help you separate and manage your debts to avoid affecting your credit score.

- Tax considerations: Provide advice on the tax implications of divorce and how to minimize any potential tax penalties.

The focus isn't about winning or losing in the settlement, it's about ushering you into your new stage of life in a financially sound and confident manner. And that's exactly what we strive to do at NewMaker Financial. Together, we can navigate this journey.

Understanding the Role of a Divorce Fiduciary Financial Planner

Divorce is an emotionally draining process that can potentially have a significant impact on your financial future. In such a situation, it becomes crucial to have a professional who can guide you through the intricate maze of financial decisions. This is where a divorce fiduciary financial planner comes into the picture.

The Specialization of Divorce Financial Advisors

A divorce financial advisor is a professional who specializes in assisting clients during their divorce process. Their primary role is to pursue an equitable division of assets, uncover potential hidden assets, and evaluate the tax implications of asset division. They work alongside your divorce attorney, providing them with crucial financial data that can impact the settlement negotiations.

At NewMaker Financial, our experienced divorce financial advisors help you comprehend your options, the true value of your assets, and how your decisions during the divorce can impact your future financial health. We strive to seek that the decisions you make today will not harm your financial situation in the future.

The Fiduciary Duty of a Financial Planner in Divorce

A fiduciary financial planner has a legal obligation to act in the best interest of their clients. This goes beyond providing advice; it extends to offering objective, unbiased financial strategies that align with the client's unique situation and long-term financial goals.

As fiduciaries, we at NewMaker Financial are committed to putting your financial needs and goals first. We are legally bound to act in your best interest, ensuring transparency and accountability in all our dealings.

The Difference Between a Financial Planner and a Fiduciary

While it might seem like the terms 'financial planner' and 'fiduciary' are interchangeable, there is a vital distinction between the two. A financial planner provides advice and guidance on how to manage your finances, but they may not always be obligated to act in your best interest. On the other hand, a fiduciary is legally bound to prioritize your interests over their own.

A divorce fiduciary financial planner is a specialist who blends the advisory role of a financial planner with the ethical obligation of a fiduciary. Their expertise lies in navigating the complex financial landscape of a divorce while upholding the highest standards of integrity and client-centric service.

In conclusion, understanding the role of a divorce fiduciary financial planner can significantly streamline the financial complexities of your divorce process. By choosing a fiduciary, you can have peace of mind knowing that your financial advisor is committed to safeguarding your financial future. At NewMaker Financial, we stand by our commitment to provide personalized, fiduciary services that protect your financial interests throughout the divorce process.

How a Divorce Fiduciary Financial Planner Can Help

Navigating the financial complexities of a divorce can be overwhelming, especially if you're already dealing with emotional turmoil. This is where a divorce fiduciary financial planner can be invaluable. At NewMaker Financial, we offer comprehensive financial planning services tailored to your unique needs during this challenging time.

Creating an Inventory of Assets

One of the first steps in divorce financial planning is creating an inventory of all your assets. This includes everything from bank accounts, property, retirement accounts, to investments. Having a comprehensive list of assets is essential for accurate valuation and fair division. Our professional advisors assist clients in this process, ensuring all assets are accounted for and accurately valued.

Valuing and Dividing Assets

The valuation and division of assets is a critical part of divorce financial planning. Understanding the true value of your assets goes beyond just their current market value. It involves considering factors such as tax implications, future growth potential, and liquidity. We guide our clients through these complex considerations, helping them make informed decisions that protect their financial future.

Uncovering Hidden Assets

As Jared Spinelli, a divorce attorney at Rubin and Rudman LLP, explains, it's not uncommon to discover hidden assets during the divorce process. Therefore, it's crucial to have a thorough examination of all financial records. At NewMaker Financial, we leverage our expertise to identify hidden assets, providing our clients with complete transparency and clarity during the asset division process.

Understanding Tax Implications

Divorce can have significant tax implications, from asset division to alimony and child support payments. Our team is well-versed in divorce-related tax issues, guiding clients through potential tax liabilities and benefits. We help clients structure their divorce settlement to optimize tax outcomes, preventing surprise tax bills from showing up at their doorstep.

Planning for Alimony and Child Support

Alimony and child support are essential aspects to consider during the divorce process. As fiduciary advisors, we help clients understand their obligations and options, and plan for these future payments. Our goal is to ensure that our clients are financially prepared for these commitments, preventing financial stress down the line.

At NewMaker Financial, our mission is to help you navigate the financial complexities of divorce, ensuring you make informed decisions that protect your financial future. By partnering with us, you can confidently tackle these challenges and set the stage for financial stability post-divorce.

When to Hire a Divorce Fiduciary Financial Planner

Navigating a divorce can be complex and emotionally draining. This is particularly true when it comes to the division of assets and addressing financial imbalances between spouses. In these cases, it may be beneficial to seek the services of a divorce fiduciary financial planner. Here are some situations when it might be prudent to engage a professional.

The Complexity of Assets

A challenge in a divorce is the division of assets. If you and your spouse have complex compensation structures or significant investments in private equity or other hard-to-value assets, the situation becomes more intricate. For instance, you may have assets tied up in retirement accounts, brokerage accounts, real estate, or businesses.

A divorce fiduciary financial planner can help navigate these complexities, ensuring that all assets are identified, valued properly, and divided fairly. They can also provide guidance on the tax implications of different assets, helping you retain assets with the highest projected after-tax value.

Knowledge Imbalances Between Spouses

It's not uncommon for one spouse to have more knowledge about the family finances. This can create an imbalance in the ability to negotiate during a divorce. If you're not intimately familiar with your family's financial situation, you might find yourself at a disadvantage.

This is where a divorce fiduciary financial planner can be an invaluable asset. They can help level the playing field by offering insights into your financial situation, helping you understand your assets, and assisting in the negotiation process. This way, you can ensure that the division of assets is equitable and fair.

High-Conflict Divorces

In high-conflict divorces, emotions can run high, and financial matters can become a battlefield. A divorce fiduciary financial planner can help defuse the situation by providing objective advice and guidance. They can also help manage the financial aspects of the divorce, allowing you to focus on processing the emotional burdens that come with the end of a marriage.

At NewMaker Financial, we understand the emotional and financial complexities that come with a divorce. Our team of divorce fiduciary financial planners are trained to help you navigate these challenges, providing you with the support and guidance you need during this difficult time. Don't navigate this journey alone - we're here to help.

Choosing the Right Divorce Fiduciary Financial Planner

When going through a divorce, it's crucial to have the right team by your side. A divorce fiduciary financial planner can make a significant difference in the outcome of your financial future. Here's what to consider when selecting the right professional for your divorce financial planning.

The Importance of the CDFA® Designation

The Certified Divorce Financial Analyst® (CDFA®) designation is a mark of expertise and specialization in the financial aspects of divorce. A CDFA® professional has gone through rigorous training to understand the financial implications of divorce and how to help clients achieve the most equitable settlements. This certification ensures that the advisor has the skills and knowledge to guide you through the financial complexities of divorce. At NewMaker Financial, we take pride in having team members with the CDFA® designation, ready to assist you through your financial journey.

Evaluating Experience and Specialties

Experience matters in divorce financial planning. An experienced divorce fiduciary financial planner will understand the nuances of different divorce scenarios and how to approach each one. Specialties also play a crucial role. For instance, if your divorce involves complex assets like businesses or real estate, you'll want a planner who has experience in these areas. Be sure to ask potential advisors about their experience and areas of expertise to ensure they align with your specific needs.

Understanding Fees and Services Offered

Transparency in fees and services is crucial. You should understand what you're paying for and what services you're receiving in return. Some advisors charge a flat fee, while others may work on an hourly basis or a percentage of assets managed. Be sure to discuss the fee structure with potential advisors, and ensure that their services align with your needs.

The Importance of Trust and Listening Skills

Trust and communication are fundamental in any relationship, and this is especially true when dealing with your finances. You should feel comfortable discussing your financial situation and future goals with your advisor. They should listen to your concerns, answer your questions clearly, and provide emotional support during this challenging time. At NewMaker Financial, we take pride in our client-focused approach, ensuring that you feel heard and supported throughout your journey with us.

Choosing the right divorce fiduciary financial planner is a critical step towards securing your financial future after a divorce. The right advisor will not only provide professional financial advice but also support and guide you through this emotionally challenging time.

Protecting Yourself Financially During a Divorce

When navigating through the financial complexities of a divorce, self-protection is key. As a divorce fiduciary financial planner, we've compiled some crucial steps to safeguard your financial future.

Establishing Separate Bank Accounts and Credit Cards

The first and most straightforward step is to establish separate bank accounts and credit cards. This helps to keep your income and debt separate moving forward. The division of joint accounts must be based on a percentage deemed fair by both parties, whether it's based on earned income or individual responsibility.

Separating Your Debt

In a divorce, it's crucial to separate your debt from your spouse's. This includes credit card debt, mortgages, and loans. It's important to understand which debts are in your name and which ones are joint. If a debt is in your name, you'll be solely responsible for it, even after the divorce.

Monitoring Your Credit Score

Keep a close eye on your credit score during the divorce process. Any changes or irregularities could indicate unauthorized activities or debts being accrued without your knowledge. Regular monitoring will help you stay ahead of any potential issues and ensure your credit remains intact.

Reviewing Your Retirement Accounts

Your retirement accounts are part of the asset division process. It's important to understand what your accounts are worth and how they will be divided. If your spouse has been the primary earner, you may be entitled to a portion of their retirement savings. A divorce fiduciary financial planner can help you navigate these complex issues.

Considering Mediation Before Litigation

Mediation can be a less expensive and less adversarial way to negotiate the terms of a divorce. In mediation, a neutral third party helps the couple find common ground and negotiate a fair settlement. This can be especially helpful when it comes to complex financial issues. However, it's still important to have your own attorney to ensure your rights are protected.

Protecting yourself financially during a divorce can be complex and overwhelming, but you don't have to navigate it alone. At NewMaker Financial, we are here to help you through every step of the process, ensuring you make informed decisions that protect your financial future.

Conclusion: The Value of a Divorce Fiduciary Financial Planner in Achieving an Equitable Settlement

Going through a divorce is a challenging and emotional time. It can be easy to overlook the importance of making sound financial decisions amidst the emotional turmoil. This is where the value of a divorce fiduciary financial planner becomes evident.

We, at NewMaker Financial, understand the complexities and emotional challenges of divorce. Our fiduciary financial planners are not just financial professionals, but also empathetic advisors who can provide emotional support during these tough times. We are committed to acting in your best interest, offering unbiased advice, and prioritizing your financial needs and goals.

By working with us, you can be confident that you are making the best possible decisions for your financial future. Our expertise in asset division, tax implications, and financial planning can help you navigate through the financial complexities of divorce and achieve an equitable settlement.

In addition, our knowledge of the emotional side of financial decisions post-divorce can help you avoid common financial mistakes that can have long-term impacts. We are here to help you overcome financial anxieties and build confidence in your financial decisions.

Your divorce does not have to define your financial future. With the right guidance and support, you can navigate this challenging time with confidence and secure your financial future. Trust us, your divorce fiduciary financial planner, to help you chart a new financial path post-divorce.

For further reading, we encourage you to explore our education center for more insights and advice on financial planning during major life transitions.

At NewMaker Financial, we are committed to guiding you towards financial success, no matter what life throws your way.